How to accurately recognise revenue using Synergist

| In: Product | Financial reporting

Projects within agencies can take on many guises. Some are quick one-offs, while others can run over many months. Some clients pay in advance, some operate on retainer systems, others like the traditional system of invoicing after each project. Which makes your 'real' monthly revenue tricky to track. And this has the knock-on effect of making it almost impossible to establish accurate profits.

You might invoice a bumper amount in one month - which on paper looks brilliant - but this could be for work not yet done. You’ve got the money, but you don’t yet know how much of this revenue is profit.

So, you do need to get a tight grip on your revenue reins to get the true picture of your financials.

Here's how you can use Synergist to effectively recognise your agency’s revenue.

What is revenue recognition?

Revenue management works by ‘recognising’ the revenue and costs to the month they are earned or used rather than when the invoice is received.

You use a system called accruals and deferrals to make sure the revenue is allocated to the right time period.

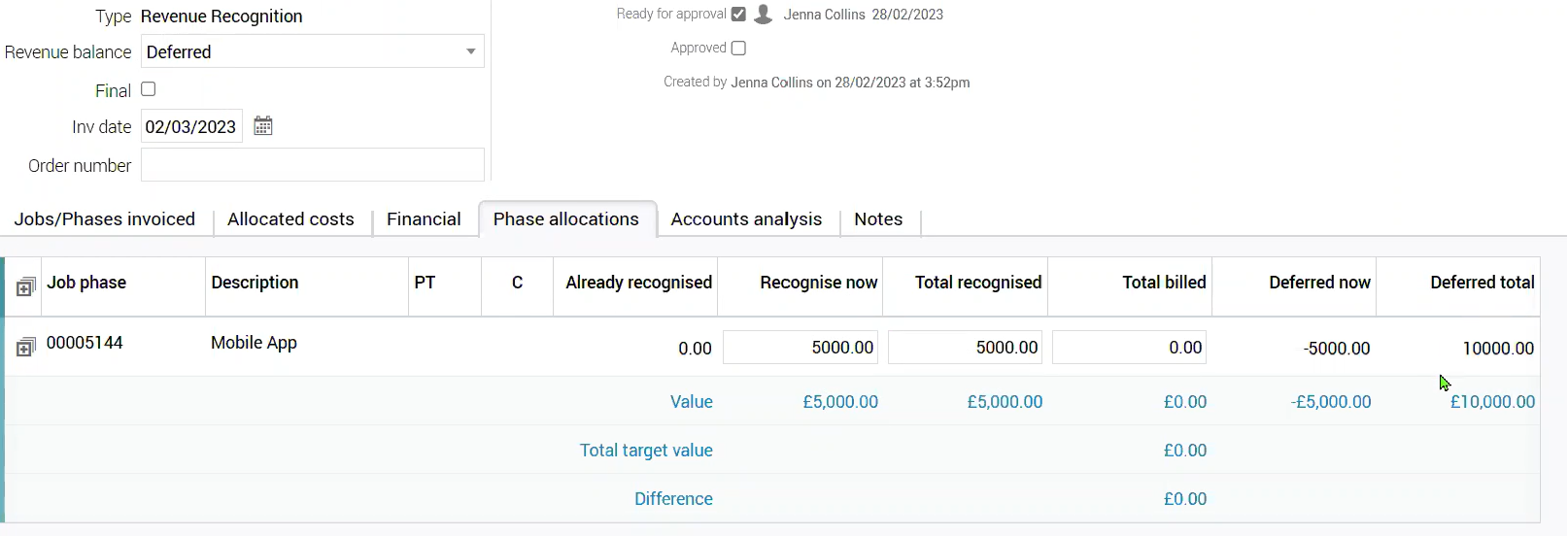

Deferred revenue. This is when you invoice a client before completing the work and defer the revenue to when the work's done.

Accrued revenue. This is when revenue is recognised based on the period the work is being delivered. For example, if you’ve completed work but not yet invoiced, revenue would be accrued against the month the work was done.

Essentially, an accrual brings a transaction forward, while a deferral delays it.

Using Synergist for Revenue Management

There are two types of revenue management in Synergist. You can recognise or defer revenue on individual invoices or use the Revenue Management module to manage revenue recognition on all jobs.

The Revenue Management module is an add-on for Synergist. Once activated, it will have an immediate impact on your reports and dashboards, so it’s worth getting to know the process before you switch it on.

The benefits of using the Revenue Management module:

- Prevents spikes in your profit and loss.

- Enables you to reconcile financial data on your accounting software back to Synergist.

- Saving time with automated processes – using spreadsheets can be time-consuming and need input from multiple team members.

- Improved job profit reporting – the ability to create a multi-job revenue recognition to allocate revenue from a 'billing job' across multiple jobs

- More accurate visibility of the remaining budget.

Deferring revenue

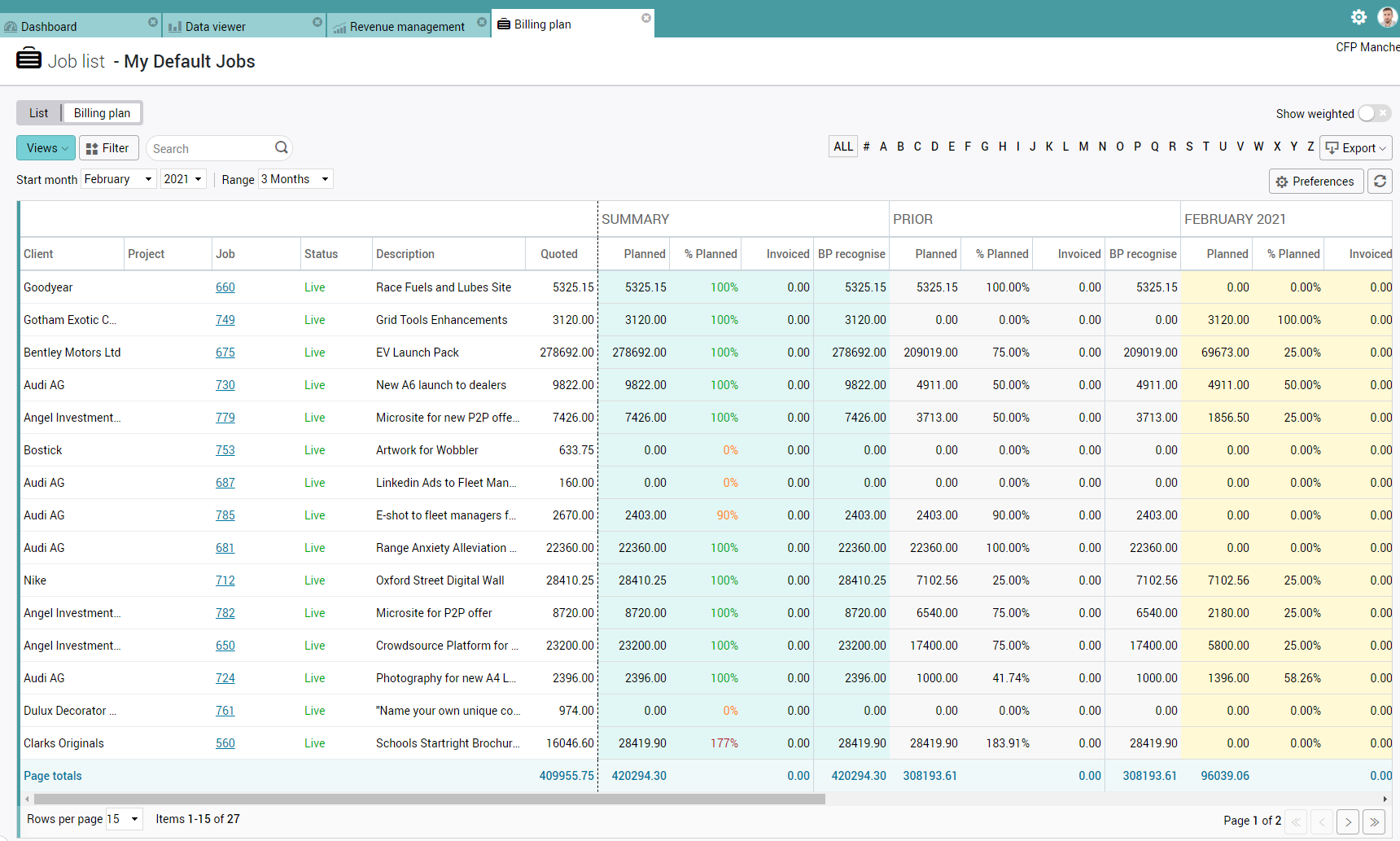

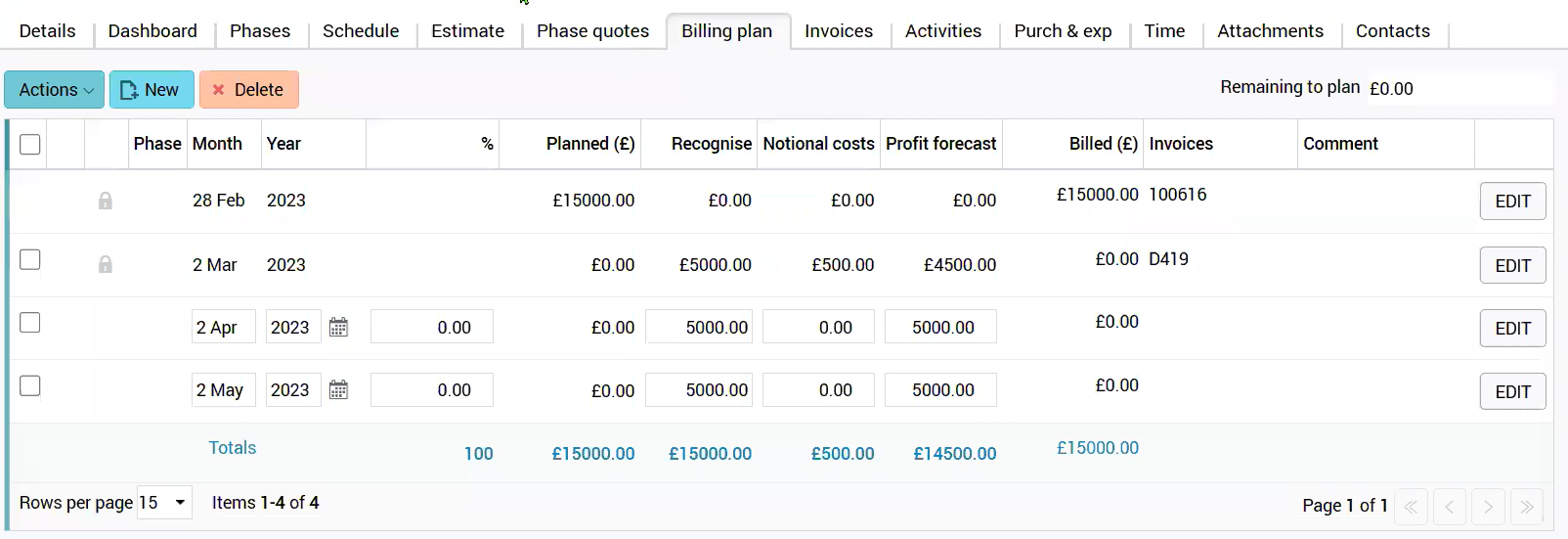

Once you’ve activated the Revenue Management module, you’ll see a new column in each job's 'Billing Plan' tab called ‘Recognise’. This relates to the revenue you are looking to recognise during that particular period. The ‘Planned value’ section is what you plan to invoice out to your client, and in ‘Notional costs’ you can enter a portion of costs you expect for that period. This then generates a profit forecast.

You can create invoices or revenue recognitions automatically from your billing plan.

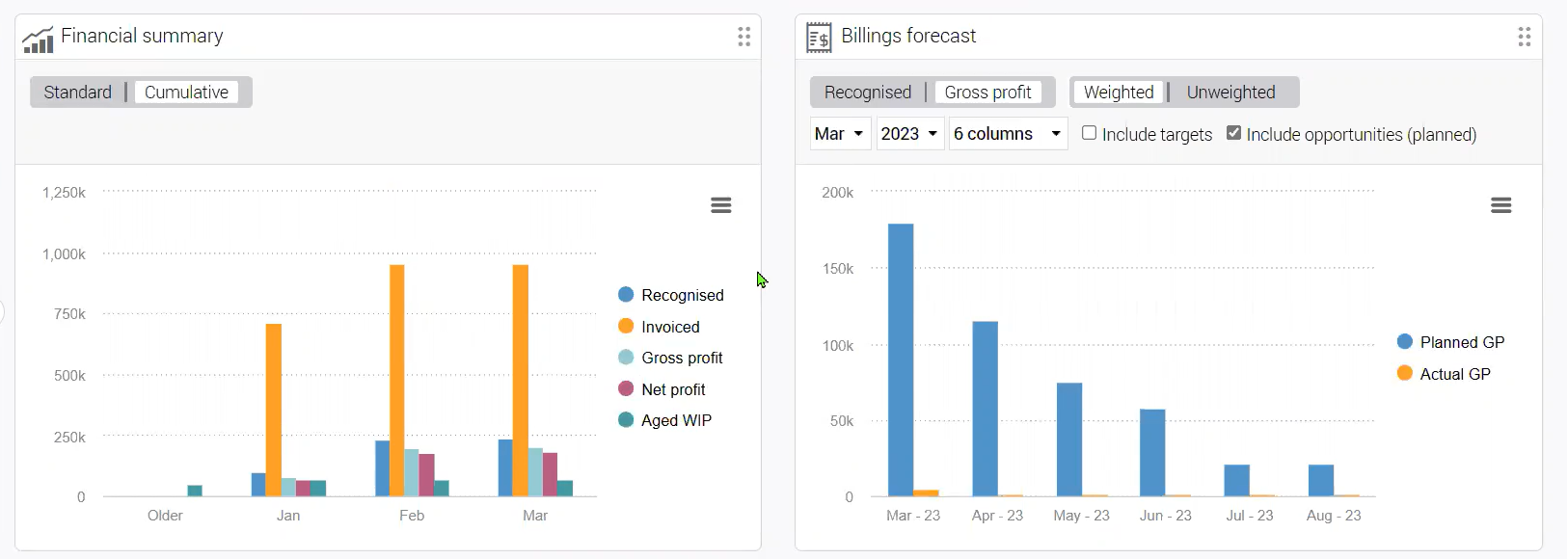

The module also has an impact on the forecasting elements within Synergist. Once the Revenue Management module has been switched on, you can also forecast when you expect to recognise the revenue.

This will give finance and client services, and ultimately the whole business, the visibility of future invoicing, revenue and gross profit forecasting.

Recognising revenue

When you want to start recognising the revenue, you can create a revenue recognition invoice - an internal invoice - and you can enter the value you want to recognise. This will remove it from your deferred income and release it to your sales nominal code.

Updating your accounting software

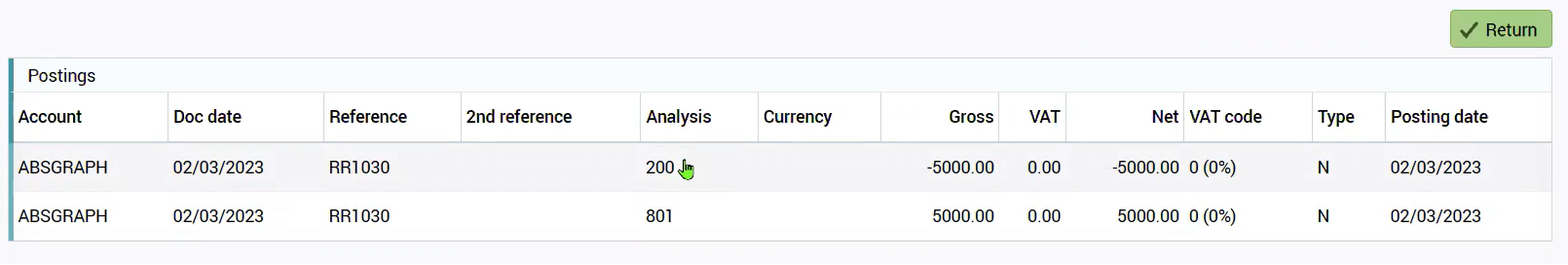

Once you’ve created these transactions, Synergist will create nominal journals that can be posted to your accounting software.

Synergist automatically posts the journals into your cloud-based accounting software. This gives you granular job-level detail within both Synergist and your accounting systems. This feature works with Zero, QuickBooks Online, Sage Business Cloud Accounting, and Sage 50 version 22 or higher.

You can also access a monthly revenue management report, where you can see totals for what’s been invoiced and recognised and overall deferred or accrued income. You can export this at month-end and use it as a manual journal to update your accounting software.

Revenue management is a key part of running your agency and it looks different for everyone, depending on how you invoice and the type of clients and projects you have. Using Synergist to keep on top of your revenue can give you full visibility for each project or phase, ultimately helping you to accurately calculate your gross profits.

Is your agency’s financial reporting based on solid foundations?

Is your agency’s financial reporting based on solid foundations?  Agency Project Profitability Reporting

Agency Project Profitability Reporting  Product update: new integrations, enhanced analytics and improved usability

Product update: new integrations, enhanced analytics and improved usability